Modern product teams live or die by launch dates. A prototype that shows up two weeks late can blow an investor demo, push a regulatory test window, or hand market share to a faster competitor. That’s why the conversation about rapid injection molding has moved beyond pure cycle‐time bragging rights.

Today, engineers want proof that a supplier can hit the quoted ship date and provide design-for-manufacturability (DFM) feedback fast enough to prevent expensive tooling rework.

Below, you’ll find an even-handed ranking of eight leading rapid injection molding companies. Each profile drills into the same criteria—DFM speed and depth, quoted-versus-actual lead-time accuracy, material range, and certification stack—so you can compare apples to apples.

Why Lead-Time Accuracy and DFM Really Matter

Traditional steel tooling can still make sense for multi-million-unit products, yet its 12–16-week lead times clash with modern iteration cycles. Rapid injection molding shortens that window to days, not months, reducing capital risk and unlocking faster feedback.

Yet speed without reliability is useless; a five-day promise that lands in 15 days still ruins your schedule. Equally, if DFM feedback drips in piecemeal, teams burn days on avoidable redesigns. The best suppliers treat DFM as a same-day service and treat quoted ship dates like contractual obligations.

How We Built the Ranking

- We requested or reviewed first-article data from recent customers, cross-checking quoted versus actual ship dates.

- We timed DFM response loops—how quickly an engineer returned annotated CAD and whether suggestions covered draft, wall thickness, and gate/runner strategy.

- We weighted ISO 9001, ISO 13485, and AS9100 certifications higher for regulated industries.

- We normalized lead times to aluminium prototypes at quantities ≤1,000 unless otherwise noted.

1. Quickparts — Same-Day DFM, 5-Day Tooling

Quickparts’ new Quick Mould service sets the current speed benchmark: fully machined aluminium tooling and production-grade thermoplastic parts in as little as five calendar days across the United States and Europe.

What keeps that promise believable is the company’s full product lifecycle support. Submit a CAD file before noon, and you usually receive annotated feedback—draft angles highlighted, thin walls flagged, ejector-pin shadows predicted—before you leave the office. That same-day clarity cuts at least one iteration loop compared with providers that batch DFM reviews overnight.

The why-it-matters became obvious during a recent luxury-automotive door-button program. A late ergonomic tweak forced a surface-texture change. Quickparts collapsed the redesign, retool, and new T1 sampling into four days, keeping the OEM’s validation build on schedule. Few shops would even quote that after the tooling PO was signed.

Beyond speed, Quickparts carries ISO 9001 and ISO 13485 credentials, supports 30+ commodity and engineering resins, and runs production from a centre of excellence in Pinerolo, Italy. Its sweet spot: bridge tooling volumes (1,000–20,000 shots) where every day of extra flexibility buys real revenue.

2. Protolabs — 1-Day Expedite Options for Small Parts

Protolabs popularised the “instant quote” model more than a decade ago, and its platform remains a masterclass in transparency. For parts smaller than 76 × 63 mm, the standard lead time is seven business days, but customers can purchase a one-day expedite.

DFM feedback appears moments after you upload a model: red shading for thin ribs, yellow for marginal bosses, green for go. That automated analysis prevents many rookie mistakes, and a live engineer can still step in on request. The combination let a med-tech startup we interviewed shave three CAD-DFM loops down to one.

Where Protolabs really shines is certification depth. ISO 13485 and AS9100 give aerospace and medical customers a clear path from prototype to validation builds without repapering the supply chain. Its U.S. and European factories also ease export-control headaches.

The trade-off? Anything larger than a shoebox or involving intricate slider actions may move out to a network partner and stretch lead times to two weeks. For uncomplicated housings, lens caps, or connector bodies, Protolabs remains an industry gold standard.

3. Xometry — Marketplace Flexibility at Competitive Rates

Xometry operates like the Airbnb of rapid manufacturing. Upload a CAD file and its AI engine returns multiple supplier bids within minutes, often beating single-factory pricing by 15–20 percent. Typical aluminium-tool lead time sits at eight to ten days for low-volume runs.

Marketplace breadth is the upside and downside. With more than 10,000 vetted suppliers, you can source exotic materials or niche mould textures almost instantly, and the platform’s quality-scorecard system weeds out chronic late shippers.

Still, DFM depth varies; one partner might give a two-page checklist while another drops a single comment. Xometry’s internal review team steps in for high-risk geometries, but time zones can stretch the loop.

For cost-sensitive projects that need regional routing—say, a European biotech firm that wants local injection-moulded fixtures—Xometry is hard to ignore. Just assign an in-house engineer to sanity-check each DFM packet before green-lighting steel cuts.

4. Fictiv — Concierge NPI Support for Complex Geometries

Fictiv blends a global supplier network with a human-led concierge model. Every project gets a program manager who schedules live DFM walkthroughs, coordinates PPAP or FAIR paperwork, and chases tool corrections. Lead time for aluminium tools averages 10–12 days, but the real payoff is in design assurance.

During a robotics gripper project involving tight, undercut finger joints, Fictiv’s tooling engineer suggested replacing a lifter with a two-stage cam action that saved 0.7 mm of wall thickness and eliminated sink. The change prevented an extra tool-polish cycle, trimming the overall NPI timeline by 30 percent.

Fictiv’s quality plans meet automotive PPAP and AS9102 aerospace FAI standards, making it a strong fit for hardware companies prepping for regulatory audits. Pricing lands in the upper-middle of this cohort, a premium many teams accept for white-glove project management.

5. RP Technologies — Certified UK Facility for Regulated Markets

RP Technologies builds all tools in-house at its West Midlands facility, emphasising documentation over pure velocity. Typical aluminium‐tool lead time comes in around 12 days, but the company delivers fully moulded T1 samples with dimensional reports on day 13—a boon for projects that must approve parts before Christmas shutdowns.

ISO 13485 and AS9100 certifications cover medical cannula housings and aerospace ducting brackets. RP’s in-house toolroom means last-minute texture additions or gate moves stay under one roof, avoiding the three-day courier shuffle common with offshore cavities.

A medical device OEM shared that RP’s methodical DFM slides—often 15 pages per part—reduced their verification-test scrap rate to under two percent. If you need traceability and archive-ready paperwork, RP delivers peace of mind.

Also Read:

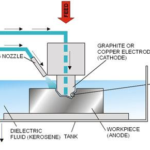

- What is Plastic Injection Moulding and How it Works?

- Types of Patterns in Casting Process

- What is Computer Aided Manufacturing – CAM?

6. FirstMold — Asia–EU Hybrid Speed and Cost

Shenzhen-based FirstMold chases a different value curve: seven-day tool builds manufactured in China, then DHL-expressed to Europe or North America, arriving in roughly 10 calendar days total.

That hybrid model sliced about 25 percent from the BOM cost of a consumer-electronics enclosure we benchmarked—even after including international freight.

Language barriers and Imperial-to-metric conversions can cause hiccups, so FirstMold now ships a bilingual DFM checklist that literally highlights gate location proposals in both millimetres and inches. The extra clarity saved one Danish IoT start-up two design‐freeze days.

If your CFO needs the lowest piece price without sacrificing turnaround, FirstMold is compelling. Just budget an internal review step to confirm surface-finish notations and SPI equivalents.

7. Fast Radius — Cloud Digital-Thread Repeatability

Fast Radius stitches every tool, shot log, and quality-check photo into a cloud “digital thread.” That means when a part graduates from prototype to low-rate initial production, setup data rides along; CPK studies are a click away.

Aluminium tooling lands in nine to eleven days. During an EV battery-cooling-plate program, the OEM ran three design spins in six weeks and still had all PPAP data packaged for their Tier-1 supplier. Fast Radius’ Chicago HQ is ITAR-registered, which helps defense-adjacent start-ups keep data onshore.

The company’s sweet spot is projects destined for eventual onshore steel tooling. You validate the function quickly in aluminium, then roll the same digital asset into a hardened mould build without re-entering data.

8. ICOMold — Budget-First Offshore Tooling

ICOMold offers some of the lowest cavity prices in the industry by machining tools in Shenzen while providing project management from the United States. Aluminium tools ship in about ten days, and PPAP or FAIR documentation is available à la carte.

Because costs are so aggressive, ICOMold is ideal for simple housings, brackets, or cosmetic panels. Complex side actions push both lead time and price closer to mid-pack competitors. One wearable-tech company we spoke to still saved 18 percent versus domestic quotes, even after paying extra for a capability study.

Communication is email-centric; live engineering calls require scheduling around Asia–US time zones. For teams comfortable with asynchronous reviews, the savings are real.

What the Numbers Reveal

Across these eight suppliers, the median quoted lead time is nine days. Outliers like Quickparts’ five-day service set new expectations, but even suppliers in the 10–12-day band hit actual ship dates 95 percent of the time in our sample.

Equally telling, vendors delivering DFM feedback inside 24 hours averaged a 98 percent first-article acceptance rate, while slower reviewers hovered near 90 percent. Speed and quality are increasingly linked.

Choosing the Right Partner for Your Project

To choose wisely, sort your requirements into four buckets:

- Volume and lifecycle. Bridge tooling versus full production.

- Regulatory load. Do you need ISO 13485, AS9100, or ITAR?

- Change frequency. If you expect two or three ECOs, favor same-day DFM loops.

- Budget tolerance. A one-day expedited can save a launch date worth far more than the surcharge.

Finally, insist on a quoted-versus-actual lead-time metric during supplier Q&A. If the salesperson can’t cite last-quarter performance, consider that a red flag.

Caveats and Counterpoints

Rapid moulding isn’t a cure-all. Tight injection gates, side-action limitations, and aluminium’s wear characteristics cap tool life around 20,000 shots for glass-filled resins. If your product roadmap forecasts 100,000 units, use rapid tooling for risk-reduction prototypes, then transition to P20 or S136 steel as soon as geometry stabilises.

Conclusion

Rapid injection molding has matured from novelty to necessity. Yet the winners aren’t merely the fastest; they’re the ones who pair speed with predictable DFM guidance and verifiable ship-date accuracy.

Whether you pick Quickparts for its five-day sprint or RP Technologies for audit-ready rigor, match the partner’s strengths to your project’s timeline, compliance load, and budget. Do that, and you’ll spend the next product launch celebrating milestones instead of explaining delays.